Everyone likes to spend money. But does it ever get out of hand? Here are a few solutions to put an end to this and get your spending under control. Making a budget, according to many personal finance experts, is essential for gaining back financial control. It’s time to make it happen!

Introduction

Lately, people can’t seem to keep track of where and how much they spend. Sometimes it seems like they just go out for one innocent drink with friends, and then end up not being able to believe their eyes when they look at their bank account the next day.

But how to deal with this problem?

What Is a Budget and How It Works?

A budget is the amount of money someone wants to spend in a certain period of time. We usually create monthly or weekly budgets to control our spending. That’s why most budget apps have been developed to follow exactly when and where your pocket money is spent. You can use them to keep track of your personal finances and thus improve your spending habits.

The best budgeting apps provide the greatest financial control by helping you understand your income/expense ratio. In order to automatically download transactions and categorize expenses, budgeting apps can be linked to your bank account and credit cards. Many even divide your spending into specific categories (e.g., transportation, personal errands, food, school, etc.), so you can see exactly where your money is going.

Why Do You Need a Budget App?

Once you link your bank accounts to the app, no expense will go unnoticed, and you will always be aware of everything that is happening with your money. In fact, it can save you from many unnecessary purchases and transactions that you probably don’t even notice in your day-to-day life. We’re talking about subscriptions or extra charges, for example. Thanks to budgeting apps, you will now know where every penny of yours goes.

With a budgeting app, you can create a financial plan for yourself to keep your expenses under control. The money you spend will no longer stress you out. By doing so, you will not only take care of your mental well-being, but also your daily life. Choosing a high-quality budgeting app will save you many hours spent manually entering data into a spreadsheet. As a result, you will have more quality time and maybe you’ll even get motivated to save more.

Best 5 Budgeting Apps in 2023

So that you can fully control your finances, we decided to make a ranking of the best budgeting apps. Remember, when you use these solutions, your bank accounts will remain completely safe, as we have compiled only the best quality and legitimate apps for you. So without wasting any time, let’s take a look them!

- Mint

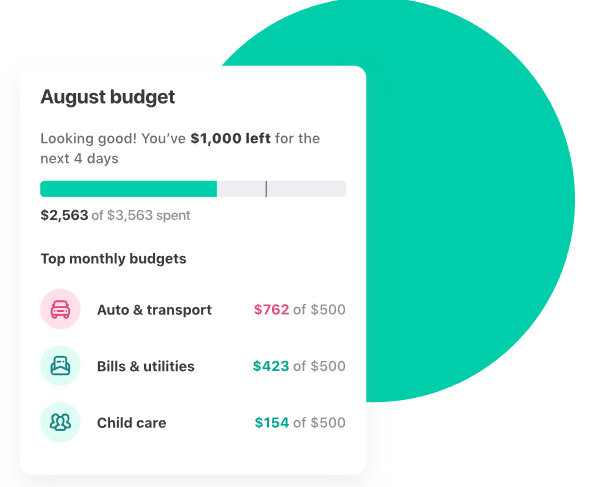

We decided to put Mint at the top of our list because it has very high ratings on both Google Play and the Apple Store. This completely free budgeting app categorizes all your expenses and presents them to you in a very organized manner. The categories are fully customizable, allowing you to tailor them to your daily routine. On top of that, you can set spending limits, and Mint will alert you when you’re getting close to them.

With Mint, you can keep track of even the smallest detail of your expenses. We’re talking about credit card accounts, loans, investments, monthly fees, and bills. You can be sure that you won’t miss a single payment and, consequently, it will be easier for you to do your financial planning. It’s safe to say that Mint is the best budgeting app out there.

- YNAB

YNAB, an app whose name means “You Need A Budget,” is ideal for fans of rigorous saving. Instead of keeping track of past purchases, this personal finance program encourages users to make financial decisions that will positively affect their future. With YNAB’s zero-based budgeting method, you can create a plan for every dollar you earn. All you have to do is let the app know how much of your income should go into specific categories, such as expenses, goals, and savings, as soon as you receive your paycheck.

The theory behind this is that when you are forced to actively choose what to do with your money, you become more intentional with it. Believe it or not, this actually works. Unfortunately, YNAB does not have a free trial or any free version. You must pay $14.99 a month or $98.99 a year to use the app.

- Goodbudget

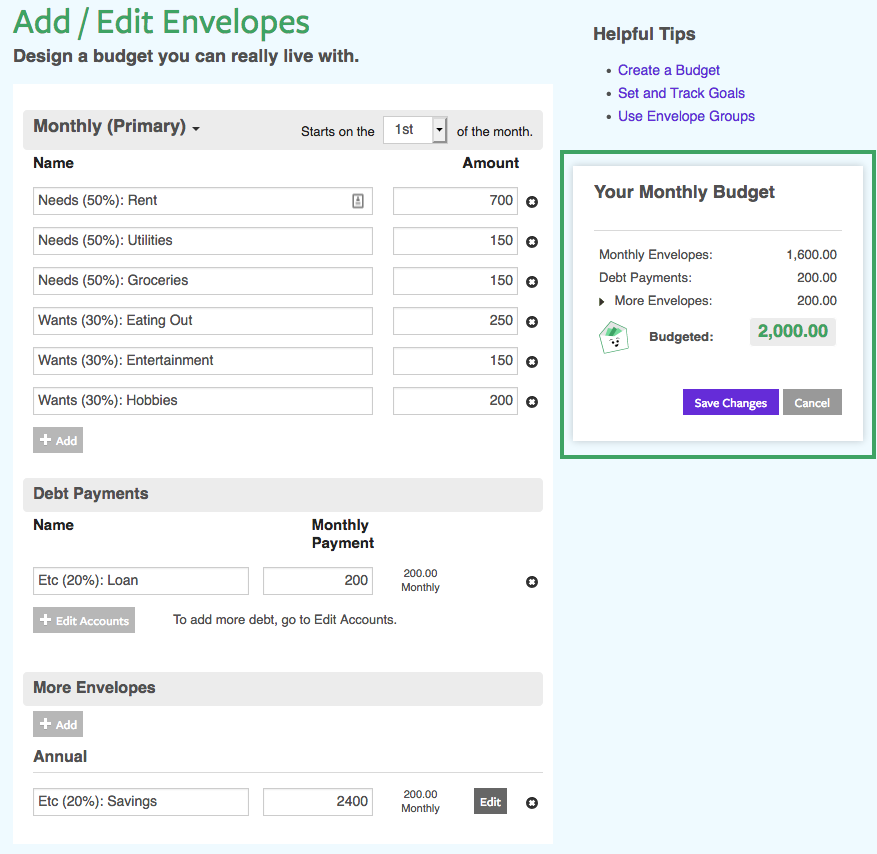

The main purpose of Goodbugdet is to finance your future expenses or to prepare a preliminary financial plan to help you control your money. In other words, it helps you prepare a more appropriate spending plan for the future by calculating your monthly expenses. Perhaps it’s not the best budgeting app overall, but it certainly does a great job when it comes to managing your finances.

One important aspect of Goodbudget, is that you do not link your bank accounts to the application. Everything is entered manually and only on the basis of the information you provide does the program help you manage your finances. For some, this can be a good thing, while for others it can be a nuisance. It all depends on what you are looking for.

The free version of Goodbudget allows one account, two devices, and a fixed number of envelopes. The paid version, on the other hand, offers unlimited envelopes and accounts, up to five devices, and additional benefits of Goodbudget Plus.

- EveryDollar

In the free version of EveryDollar, just like in Goodbudhet, instead of linking your bank accounts to the app, you enter everything manually. In addition, you categorize budget items yourself and set reminders to pay bills. Being a free app, you have to pay to enjoy certain perks. Nevertheless, we can still classify EveryDollar as one of the better budgeting programs.

In the premium version, however, your purchases automatically appear in the app, which also offers recommendations and personalized reports based on your activities. In addition, you can easily link your investment and financial accounts to it.

- Personal Capital

Most budget apps offer virtually the same functions, but nevertheless, some are definitely better than others. Their advantage lies in the fact that they are free, while at the same time, they do not limit their capabilities too much. Personal Capital makes another entry in our list of the best budget apps, as it offers a great free trial.

The app presents the user with a summary of his recent purchases, while also categorizing them. The categories can, of course, be edited according to one’s lifestyle. In this way, Personal Capital allows you to see which category “devours” the largest part of your monthly budget.

How to Choose a Budgeting App?

To choose the perfect budgeting app, you first need to know exactly what you’re looking for. For example, do you need to know exactly how much you spend, or do you need to categorize your expenses? When you find the answer to that question, you will realize that there are many budget apps that suit your needs.

Next, the important thing is whether these apps are free or not. It’s crucial to do all the necessary research before you make your decision. While some programs may initially seem free, once you download them, you’ll find that all the essential features are only available to premium subscribers. Consequently, you can’t really use them without spending money. That’s why we recommend that you investigate your options thoroughly.

Conclusions

There are plenty of apps on the market for controlling your monthly budget. Choosing the right one may seem like a challenge at first, but once you carefully review their offerings, you’ll discover that setting your own expectations is key. After that, finding the right program will be a piece of cake. So if you’re looking for a solution to your financial problems, be sure to read our article and see which of the featured apps best suits your needs.